Cloud solutions in the contact center market have grown dramatically, as enterprises continue to acquire new customer engagement solutions or replace their existing premises-based contact centers. And many enterprises are finding that cloud contact center solutions have feature sets and functionality that match or surpass those of legacy premises-based systems.

However, when it comes to deciding on a cloud contact center offering in this rapidly evolving marketplace, it can be difficult. The choices are plentiful, and cloud contact center solutions and vendors are diverse. Enterprises have the option of going with a legacy contact center vendor, cloud-only multitenant player, emerging niche solution vendor, or large telecom or outsourcing provider. Additionally, cloud contact vendors are enhancing their offerings by making strategic acquisitions in the customer engagement market space and spending R&D dollars to further develop their solution capabilities.

In

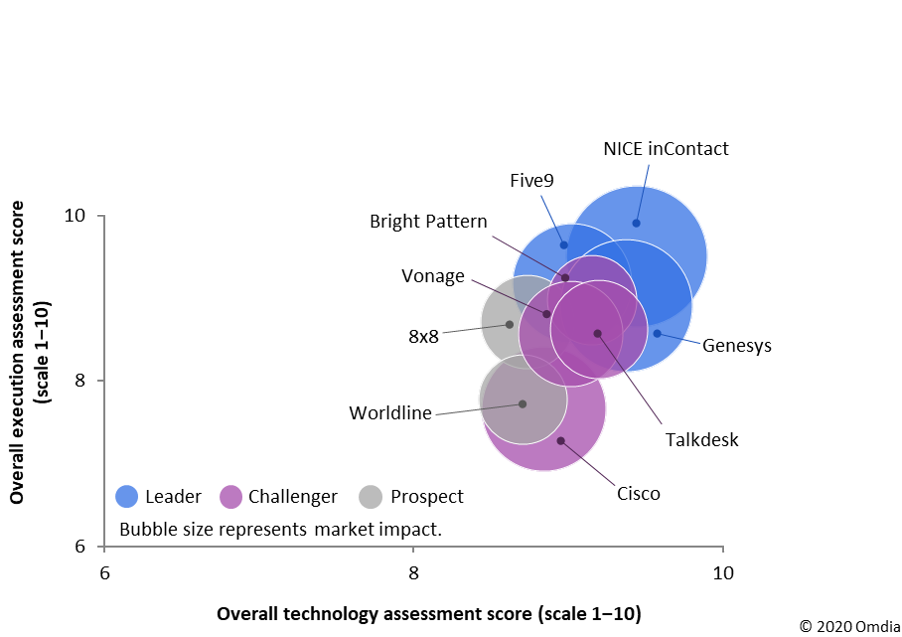

a recently published Omdia report, nine of the leading cloud contact center solutions, each with offerings that handle multichannel customer interactions and provide customer analytics, were analyzed. The report compared solutions based on the strength of their technology platforms, customer satisfaction, and the market impact that each company currently has in today’s environment. Omdia compiled the selected group of vendors for comparison based on their ability to offer full voice-call routing in the cloud and to route one or more additional interaction channels. The summary graphic shown below is the result of a thorough investigation of each of the vendor’s technologies, market execution as evaluated by a sampling of its customers, and the company’s current market impact based on cloud-based revenues, year-over-year growth rates, vertical and global market reach achievements, brand name recognition, and average customer agent size.

The evaluated companies were grouped into three overall categories: Leaders, Challengers, or Prospects. The leaders, based on their overall average scores across the three categories of measurement — technology, execution, and market impact — were NICE inContact,

Genesys, and Five9, listed in rank order. Based on the same measurement system, the challengers were Cisco and Vonage (tied) and Bright Pattern and Talkdesk (tied), in that order. The remaining vendors 8x8 and Worldline were classified as prospects, or companies worthy of consideration by enterprises with specific product requirements such as a vertical market expertise, size requirements, or a specialization in the merged CCaaS and UCaaS environments.

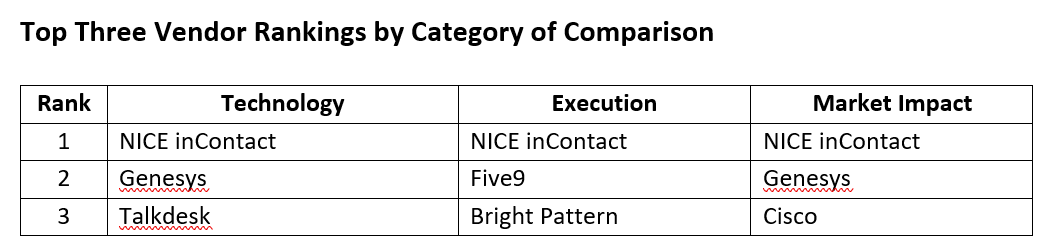

While Omdia believes all these vendors may be considered as tier-one providers given the set of specific requirements and specifications of an end user’s circumstances, the ranking system was based on overall category averages. To create a shortlist of candidates, Omdia suggests that enterprises choose a provider based on criteria that is important to them, selecting vendor offerings that matches their specific need. The below table shows how a top provider can change, depending on the criteria.

As seen in the chart, NICE inContact received a top rating in all three categories. Genesys and

Talkdesk followed closely behind NICE inContact in the technology category. Five9 and Bright Pattern placed second and third in the execution rating, respectively. Genesys and Cisco rounded out the top three in the measurement of overall market impact. In other words, the best solution for any enterprise should weigh both the individual and aggregate weight and importance of each category of the analysis to optimize their solution selection.

The relative closeness of the scores for all the vendors, especially in the area of technology, indicates an industry where fierce competition has resulted in a series of baseline technical capabilities being table stakes for market entry. Going forward Omdia believes company differentiation will increasingly be based on its experience and performance in market segments, targeted customer sets, the quality of consultative professional services, the effectiveness of global channels, and degree of integration with other related applications and technologies they may have in place or are considering adding.

The Omdia study also revealed several findings and market trends based on the analyses of the vendor solutions and the input from their customers. They include:

- Technology differentiation between vendor solutions is less significant than Omdia observed in its last report published in late 2017, and any technological advantage, when it exists, does not last as long as it had before, making the categories of execution and market impact more relevant to a purchase decision in the eyes of customers and prospects.

- The move to contact center cloud technology is becoming increasingly common across all vertical markets and contact center sizes, and even in the outsourcer market segment of users.

- Multitenant cloud solutions are more mature, secure, and fully featured than ever before, making them viable for even large contact centers with thousands of seats.

- The current challenge for many cloud contact center providers will be global expansion for the dual purpose of serving multilocation global clients to move upmarket and to maintain there only level of revenue growth.

- Enterprises are actively deciding whether they will choose a multitenant public cloud solution or host their solution in a private cloud depending on several factors, including data privacy, security, tolerance for risk, and often other vertical-market-specific requirements.

- There will continue to be an opportunity to sell hybrid solutions to organizations that want someone else managing portions of their platforms or to easily add some cloud-based applications, while they retain some control of their CX environment and security of their customer data, until they can comfortably move to an all-cloud solution.

- Both the legacy and newer CCaaS vendors are ramping up product differentiation with advanced multichannel interaction capabilities and other services and capabilities such as artificial intelligence, conversational interactive voice response (IVR), big data, and Internet of Things interoperation capabilities.

It is Omdia’s recommendation that enterprises seeking to select a cloud contact center vendor should consider not only the vendors’ current offerings but also how the potential solution will be able to add new functionality in stages as needed. Vendor roadmaps, technology partnerships, and investments in cloud infrastructure, as well as security capabilities, should also be reviewed as part of the selection process. This is especially true when considering offerings from both legacy-premises-based solution vendors that have entered the cloud marketplace through internal development or acquisition, and those that were “born in the cloud.” Also, the technology providers offering both premises-based and cloud or hybrid offerings need to be prepared to clarify how their cloud migration and R&D strategies will affect clients going forward.