Last week Twilio held its annual customer, partner and analyst event, Twilio Signal. As usual, Twilio packed the week with newsworthy announcements. The biggest announcement was

Twilio Engage, an automation platform that helps marketers deliver omnichannel campaigns fit for the digital era.

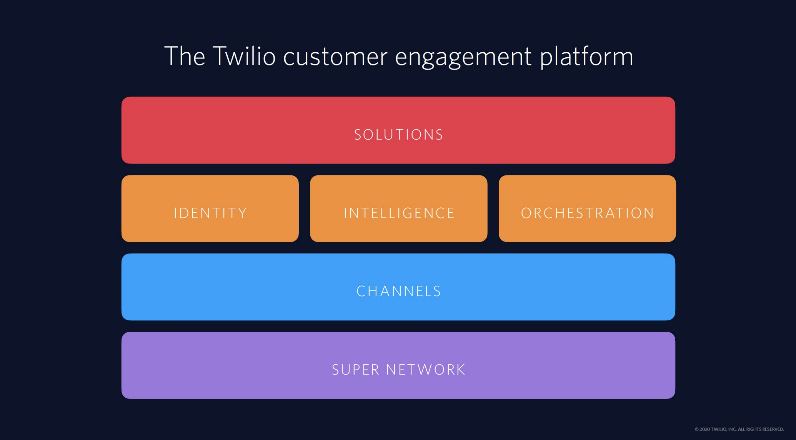

To understand the significance of the Engage announcement, let me discuss it in the context of the marketecture Twilio used to describe its portfolio three years ago (shown below). At that time, Twilio was primarily known as a company that delivered communications APIs. As such, the bottom two layers of the diagram were the most important.

With a series of announcements since then, the solutions layer of the stack has now become the area where Twilio is concentrating its development efforts. In 2018, solutions were built by developers within companies using the building blocks shown in the above graphic, e.g., identity, intelligence, and orchestration in addition to channels and the network. Today, solutions have come to mean a set of capabilities packaged to address a specific use case, e.g., service, sales and/or marketing.

Service: Twilio Flex

Contact center was a natural first solution for Twilio as a number of businesses had already begun using components from Twilio to build contact center applications. While Flex included many of the components required to deploy a contact center, it was described as a programmable contact center, still more “build” than “buy.”

In the years since its announcement, Flex has continued to mature. At Signal 2021, the company introduced Flextensions — turnkey solutions built on Twilio's Flex platform. One of the new Flextensions highlighted was Xcelerate by Waterfield Technologies, an out-of-the-box solution to deploying a feature rich, omnichannel contact center, in days. With Waterfield’s Xcelerate, think of Waterfield taking on the role of much of the “build” of Flex, making it more “buy” than Flex has been in the past.

Sales: Twilio Frontline

Frontline, a programmable application that helps sales teams securely connect with customers everywhere, was born of the rapid shift from in-person retail shopping to the near-100% digital commerce that occurred with global COVID shelter-in-place orders in March 2020. As discussed in

a No Jitter article in September 2020, the solution is a mobile app intended to allow frontline workers to engage with customers from their personal devices in a seamless and secure manner.

Data: Twilio Segment

In October 2020, Twilio announced the acquisition of the leading customer data platform (CDP),

Segment. Segment’s customer data platform technology was planned to operate as a layer between communications and the application or solutions layer, which included Flex, Frontline and marketing campaigns — a solution developed after the acquisition of email API platform,

SendGrid.

Marketing: Twilio Engage

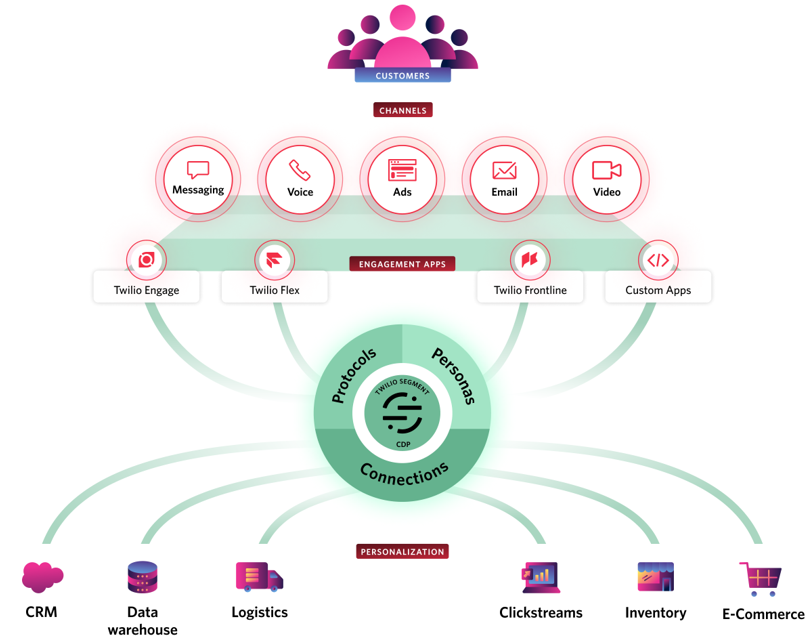

Let me highlight the differences between the first and second visualizations of the Twilio portfolio. The biggest change is the center of the 2021 version, the customer data platform, comprised of Twilio Segment CDP.

While initially important for the personalization required to create successful marketing campaigns, CDPs are increasingly being thought of as key to collecting and analyzing data required to similarly personalize sales and service interactions with customers.

On the bottom of the graphic, we see all types of enterprise data being fed into the Twilio Segment CDP, which after being organized and analyzed, can be used to feed all the customer-facing applications: Engage, Flex, Frontline, and custom applications. Those applications, in turn, deliver messages or interact with customers with any of the many channels APIs Twilio has created.

For some companies, Twilio’s approach to bringing all customer engagement into one platform will work. Primarily, I believe, these will be digital-first companies like

Vacasa. The vacation rental management’s director of engineering Danny Varner and senior product director Subechya Person joined me for a panel discussion at Twilio Signal 2021 and spoke of the reasons why the company moved from an out-of-the-box cloud contact center solution to Twilio Flex.

Vacasa had three different contact centers serving renters, owners, and sales prospects, and they found that previously, one solution did not work for all three use cases. However, they were able to meet the unique user interface demands of the three constituencies using a single solution using Twilio Flex. Vacasa was also a Segment CDP user before Segment’s acquisition by Twilio, so they are a perfect candidate for the new Engage solution.

Other companies, including many that still depend on premises-based contact center solutions, are and will continue to be attracted to the ability to deploy Twilio solutions on top of their existing solutions. In this way, without replacing what they have, they can still incorporate innovation.

What companies might one describe as competitors to Twilio’s Customer Engagement Platform approach? From a contact center perspective, Genesys and NICE each have strategic visions that include broadening their use cases to include marketing to the traditional sales and service contact center use cases, discussed in my last

No Jitter post. From a CDP perspective, Segment competitor

Treasure Data recently announced its CDP for Service and CDP for Sales offers. Finally, Salesforce — with its Sales, Service and Marketing Clouds — is another company looking to bring the entire customer journey into focus for businesses.

I would not consider any one vendor to be ahead or another to be playing catch-up. The e-commerce boom and digital transformation acceleration caused by the pandemic have alerted enterprises and solution providers alike that consumers are ready for a new way of interacting with businesses. From the recent stream of announcements hitting the sales, marketing and service theme, it appears enterprises will have a choice of approaches and vendors.