For most No Jitter readers, the cloud represents an opportunity to change telephony business models coupled with the challenge to deliver or consume communications solutions that correspond to the cost and reliability of existing on-premises solutions. When we discuss cloud and UCaaS, we’re usually looking at it through user and vendor views.

In the financial world view, however, cloud represents monthly recurring revenue, or MRR (sometimes called annual recurring revenue, or ARR). MRR has become the new holy grail for technology companies in the enterprise communications space. As Timothy Chao, author of “

Seven Clear Models of Cloud Computing,” stated, “Cloud is not a technology, it is a business model.” The stock value for many technology companies has become directly tied to their delivery of a sustainable MRR business model.

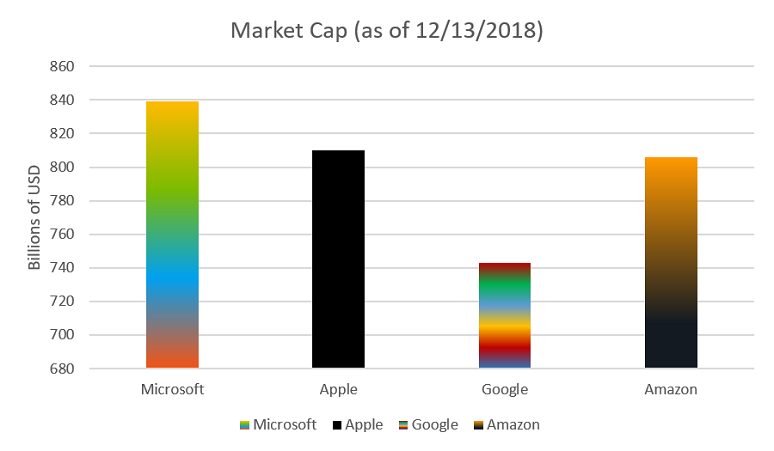

On Nov. 30, 2018, Microsoft’s market cap topped Apple’s, making Microsoft the most valuable publicly traded company in the world.

Numerous Wall Street publications have largely attributed Microsoft’s significant rise in market capitalization to its cloud computing solutions, including Azure cloud services and Office 365.

Many experts believe that Microsoft has significant upside remaining because Microsoft’s growing cloud business generates lots of MRR. Google and Amazon, two other companies that generate substantial MRR through cloud services, also have tremendous market capitalizations.

The financial market’s MRR focus is having a significant impact on the communications market, where nearly all vendor and service provider companies are strategizing on how they can increase their own monthly recurring revenue, and hence, their own valuations. In the balance of this article, we’ll discuss three MRR perspectives accompanied by our analysis of how we believe Cisco, Avaya, Mitel, and NEC -- the market leaders in terms of telephony installed base -- should each execute to achieve their best valuations.

Continued on next page: Cisco + BroadSoft Examined Through an MRR Lens