When Cisco announced its

acquisition of Voicea earlier this month, I tweeted that Amy Chang, Cisco’s general manager of collaboration technology, was “getting her piece of the Cisco acquisition pie!” Today, the contact center organization that reports to Chang gets its slice with the announcement of an intent to

acquire startup CloudCherry.

As is typical with a

tuck-in acquisition of a privately held firm, financial details of the transaction haven’t been disclosed. What we do know is that the deal is expected to close in the first quarter of Cisco’s fiscal year 2020, ending Oct. 26, 2019, and that all of CloudCherry’s 90 or so employees will join the Cisco Collaboration organization and report to Vasili Triant, general manager of the contact center business unit.

CloudCherry, founded in 2014, is a

Cisco Investments portfolio company. Through its investments arm, Cisco invests $200 to $300 million annually in companies seeking series A to late-stage growth funding. The portfolio comprises more than 120 companies all over the world. Cisco Investments also funded Voicea, and you get the sense that there’s a level of grooming that goes on at Cisco Investments that sometimes, but certainly not always, results in acquisition.

As CloudCherry Co-founder and CEO Vinod Muthukrishnan is quoted as saying on the Cisco Investments home page, “The portfolio development team at Cisco Investments is our strategy and GTM team rolled into one.” Cisco Investments participated (along with other investors) in two early funding rounds (in 2016 and 2018) that brought CloudCherry $15 million.

What does CloudCherry do? The company has developed a customer experience management (CEM) solution that offers APIs, predictive analytics, and customer journey mapping with integrated sentiment analysis. Still not sure what it does? On its website, CloudCherry shows a third-party report that includes the company in a comparison of enterprise feedback management products. And Gartner has included CloudCherry in a voice of the customer (VoC) market guide.

CloudCherry’s closest competitors in these industry reports — and mentioned by Cisco during a briefing on the acquisition — are Qualtrics (acquired by SAP in 2018), Satmetrix (acquired by NICE in 2017), and Medallia (which filed for a $100 million

IPO this June). It’s clear from these recent market moves alone that VoC, and more broadly customer engagement management, is a hot market.

Cisco knows firsthand what CloudCherry can do because it’s been a customer for a couple of years. “We have adopted Net Promoter Score as a metric that corporate payout and corporate bonuses are tied to. Everybody logs onto our (internal) homepage to see our NPS score,” said Zack Taylor, director of strategic communications for the contact center business unit at Cisco, during our telephone briefing. CloudCherry fits right into what Cisco is doing to close the loop on any bad customer experience by finding detractors and contacting them, he added.

In addition to Cisco,

another key CloudCherry customer is Puma, Taylor confirmed. A leading global sports brand, Puma was finding it difficult to collect and take action on customer feedback across its stores in Singapore. Initially, the company relied on insights from mystery shopping audits to improve the in-store shopping experience. This was both time consuming and cumbersome.

Powered by CloudCherry’s CEM solution, Puma was able to harness the power of feedback data and draw intelligent and actionable insights from it. These insights helped the brand deliver personalized experiences, address negative feedback on time, and improve customer loyalty in a dynamic retail environment.

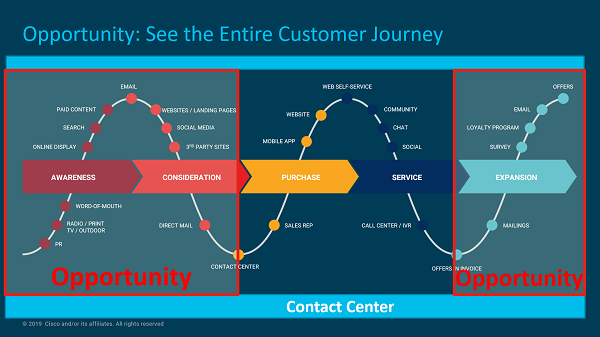

The graphic below gives a sense of what Triant and team think that CloudCherry can add to the Cisco contact center portfolio. For several years, customer journey has been a much-discussed topic in the contact center. However, customer journey in this regard has typically been applied only to those stages in which the contact center was an active participant — typically sales and service. But in looking at the graphic, which super imposes the phases of the classic buying cycle on customer journey activities, it becomes clear that there are many steps where the contact center is neither involved nor has an adequate level of visibility.

In my briefing with the Cisco contact center team, I sought to understand the role CloudCherry could play in the portfolio. One message was clear, reinforced in a blog posted by Triant on Cisco’s blog site today: While CloudCherry has taken a cloud-based, API-driven approach, all Cisco contact center customers — whether they’re using Webex Contact Center in the cloud, hosted, or on premises — will be able to take advantage of the solution.

Using the predictive analytics capabilities of CloudCherry, Cisco is also looking to replace the resale agreement that the company had with Altocloud. When

Genesys acquired Altocloud last year, the ink was barely dry on that Cisco

SolutionsPlus agreement (just 15-days old). But both the initial agreement to resell Altocloud, and the decision to acquire CloudCherry, speak to an understanding that the contact center world is expanding. Genesys has been talking about addressing sales, service, and marketing for almost two years now. Former Cisco contact center general manager John Hernandez, now CEO of Selligent, is busy partnering with contact center solution providers and systems integrators (including Genesys, Servion, and TTEC) to bring some of the pieces shown in the graphic above.

As we begin to develop the contact center and customer experience program for Enterprise Connect 2020, we too see these shifts in the landscape, and plan to explore them in the Contact Center & Customer Experience track.