The potential for cloud communications providers to impact the telephony cost structure has been a point of discussion for the last five years, further illustrated by the $10 Zoom Phone offer shown

at Zoomtopia. As the cloud deployment model emerged, I predicted a 50%-75% decline in the cost of business telephony, and now it appears that we are reaching a $5/month subscription for individual phone licenses that bundles video meeting and telephony. But how soon will telephony costs be a sub-segment of overall communications costs?

Cloud: The Industrial Revolution of Information Tech

Timothy Chou wrote a book called “

Cloud: Seven Clear Business Models” back in the 2000s about how cloud computing would change IT. While the book is somewhat dated today, the basic concept was simple. He argued that as the deployment model for software-based systems moved away from on-premises with customer-owned hardware/software, and enterprises outsourced admin staff, customers would see a cost reduction. He argued that cloud did three things that dramatically reduced the cost of providing the service, which includes:

- Standardization — the offer becomes standardized, so the cloud provider does not customize to each customer

- Specialization — the cloud vendor specializes in a specific area (versus a channel that aggregates different solutions)

- Repetition — the volume of the aggregated business is so large compared to individual deployments that the process optimization and improvements become significant.

For example, CRM software has already seen a cost reduction. The cost of Siebel CRM or another traditional CRM system was $7-10K in 2005 and included the admin staff, the software, upgrades, maintenance, facilities, servers, etc. By 2015, Salesforce had changed the market to a $60/month model, a 10x reduction from the previous model. While added capabilities may raise the price, the point is clear.

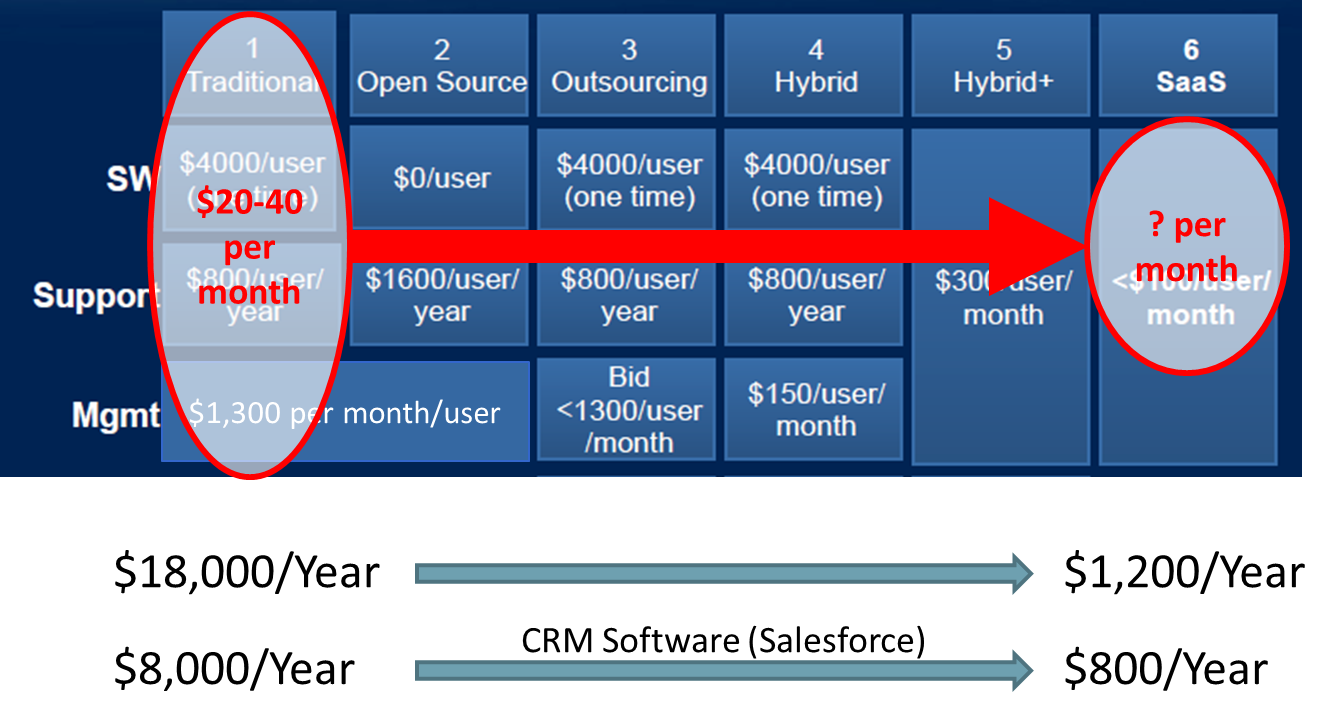

The current deployment model of cloud is the Industrial Revolution of information technology. The Industrial Revolution concentrated production into factories that used the emerging rail (and canal) systems to get products to market. The result was a huge transformation from local bespoke manufacturing (think the local blacksmith) to factories that used standardization, specialization, and repetition to reduce the labor cost in things by 90-99%. Cloud is the same transformation in information, doing the processing in cloud servers (factories) and using the Internet (new paradigm) to deliver the value to the customer, anywhere in the served area (now global). Back in 2017, I was overlaying the cost of telephony on the Chou model. The figure below shows the six paid models, Chou’s cost reductions, and where voice services will go. However, if everything else has a significant end-user cost reduction, why will that not apply to communications?

In fact, this process is happening now in telephony, as we move to cloud service delivery, and it appears to be only accelerating. A typical business phone price hasn’t changed much in the last 40 years. In the late 90s, a typical business phone cost between $17-20 per month for the phone, the PBX, the trunk line, connections, etc., but it didn’t include PSTN dialing access fees or the employees administering the systems. That was the price/cost of a basic Centrex phone (an analog landline business service), and it was typically the same for an on-premises solution. While VoIP was positioned as a way to reduce costs, added network complexity has meant that the price of phones remained much the same. An $18/month per telephone seat is a reasonable starting point to evaluate how pricing is changing.

Other costs are also changing. PSTN access costs have been decreasing for decades (remember when long distance in the U.S. had an actual cost?). Today, the average PSTN cost per employee is around $6-10. If combined with basic phone, the cost for a phone license with PSTN would be about $25, a price that is pretty standard for a cloud phone service for the last few years. While the PSTN costs have dropped somewhat, Gartner has indicated in their research that with newer systems that include video in an on-premises deployment, the admin costs increase up to half of the total costs.

For example, a 1,000-user organization might have a three-person comms admin team, which includes three salaries that need to be amortized. If the admin staff averaged a salary of $80K, and there is a 50% burden, then each head costs $120K for a total cost for the group old $360K. Dividing that by 1,000 employees shows that the average monthly cost per employee of admin is actually $30 per month. One key concept of the cloud is eliminating this cost, which has been the case many cloud vendors make.

But What About Cloud Telephony?

However, it is now clear that vendor charges for cloud telephony services are rapidly dropping. If we assume that the street price for a telephony-only service, including PSTN charges, was $25 in 2018, there have been some clear indicators that that was dropping.

Dialpad introduced an all-in service for $15. More recently, LogMeIn introduced their all-in-one GoToMeeting service for $20. There have been multiple examples of this cost reduction in cloud migrations, a Masergy/Cisco/BroadSoft customer with a $15/phone cost point and the Avaya hosted (near-cloud, no PSTN charges) for Bosch at an estimated $6/month come to mind. Clearly, the market trend is a 50% reduction for telephony costs based on cloud deployments.

The big driver of telephony cost reduction is the adoption of video. Companies are gradually replacing telephony with video meetings as their preferred comms method, which reduces both usage and PSTN access costs. Bundling video (meetings) and telephony has also become a trend. Zoom announced a telephony offer as an extension of their meetings offer;

RingCentral has moved to a bundle with their new meetings service and telephony. This trend is not just in the cloud disrupters; it’s also in the large players. Microsoft enhanced their Teams bundle with Office to include telephony services (at $10-12/month). The new bundle, including telephony, Meetings, and Teams, from several vendors is now approaching the same $25/month. That bought only telephony two years ago. Now that solution is a complete bundle for $25. The question is what is the value of telephony in that bundle and what about when you take it out?

In the Cisco Flex pricing announced over a year ago, Cisco moved telephony into a new category and include telephone “entitlements” in the basic UC license. In the Flex plan, each UC license (Meetings/Teams) includes an entitlement to a separate phone. In the current model, an open area phone or un-assigned phone is provided free for every two licenses. In this model, other than the device cost, there is no cloud vendor charge for the next phone added. In the new Cisco Webex Work offer for 100-1,000 user organizations, an added phone is priced as a separate item. In this model, an organization buying 100-1,000 Webex Meetings/Teams/Calling bundles for $20 or less monthly (as low as $15 with discounts) can buy additional telephony only phone licenses for under $3/month.

This gives us a view of the new value of telephony in the marketplace. Today, telephony is included in the bundle without discernible delineation of value or seems to be moving to a sub-$5/month. Market cost point for the basic service without PSTN costs, a very reasonable path. Once a user has access to the telephony/VoIP cloud service, there is minimal actual ongoing cost. Telephony costs for user management, provisioning, signaling, etc. are minimal, and even storage is virtually non-existent unless you are recording. And unless you need to record, most VoIP cloud systems make 1:1 calls via direct media paths, so traffic is never handled by the vendor.

A 2010 analysis of the costs of deploying a telephone seat versus an email account showed that the email account might have higher costs (not including PSTN access costs). As email is delivered as a free service, charging $20 for something that has the same underlying delivery costs isn’t sustainable. This point is further emphasized by Google Voice, a free single number service that manages all the calls, including media. Google uses some of the recorded data for their speech engine development, but it’s clearly a low-cost service.

Integrating the outlook for telephony costs into business planning for communications is critical. The rapid adoption of video meetings driven by WFH will drive investment and usage, reducing the need and focus on telephony, while costs are simultaneously decreasing. For many organizations with an existing on-premises deployment, their stand-alone telephony system costs $10-15 per user. If that organization needs a meetings/team’s platform, combining the telephony service as a cloud solution will result in significant overall cost reductions. For organizations with a telephony solution, committing to a five-year service contract, even at a 20-30% reduction from current costs may be a poor decision. The rapid acceleration in video meeting adoption due to COVID-19 accelerates both adoption and cost reduction trend; a 30% reduction from a $20 starting level may look expensive in five years when PSTN/telephony charges are converging on sub-$5 as an add-on to an overall meetings and collaboration solution. As telephony needs are included for meeting users and provided for free or under $3-5 for other phones as part of a solution, spending $12-15 per phone location in addition to the meetings costs may become untenable.

Now is a time for decision-makers to anticipate disruptive changes, and flexibility may be key to optimizing services and costs over the next few years. Telephony isn’t going away, and it isn’t going to be free. However, telephony is no longer the focus of communications investment in the industry, and the value for telephony as part of the overall communications bundle appears to be an ever-decreasing portion.